Epic Begins Campaign Against Apple and Google Over App Store Practices (Epic v. Apple I)

THE BIG PICTURE

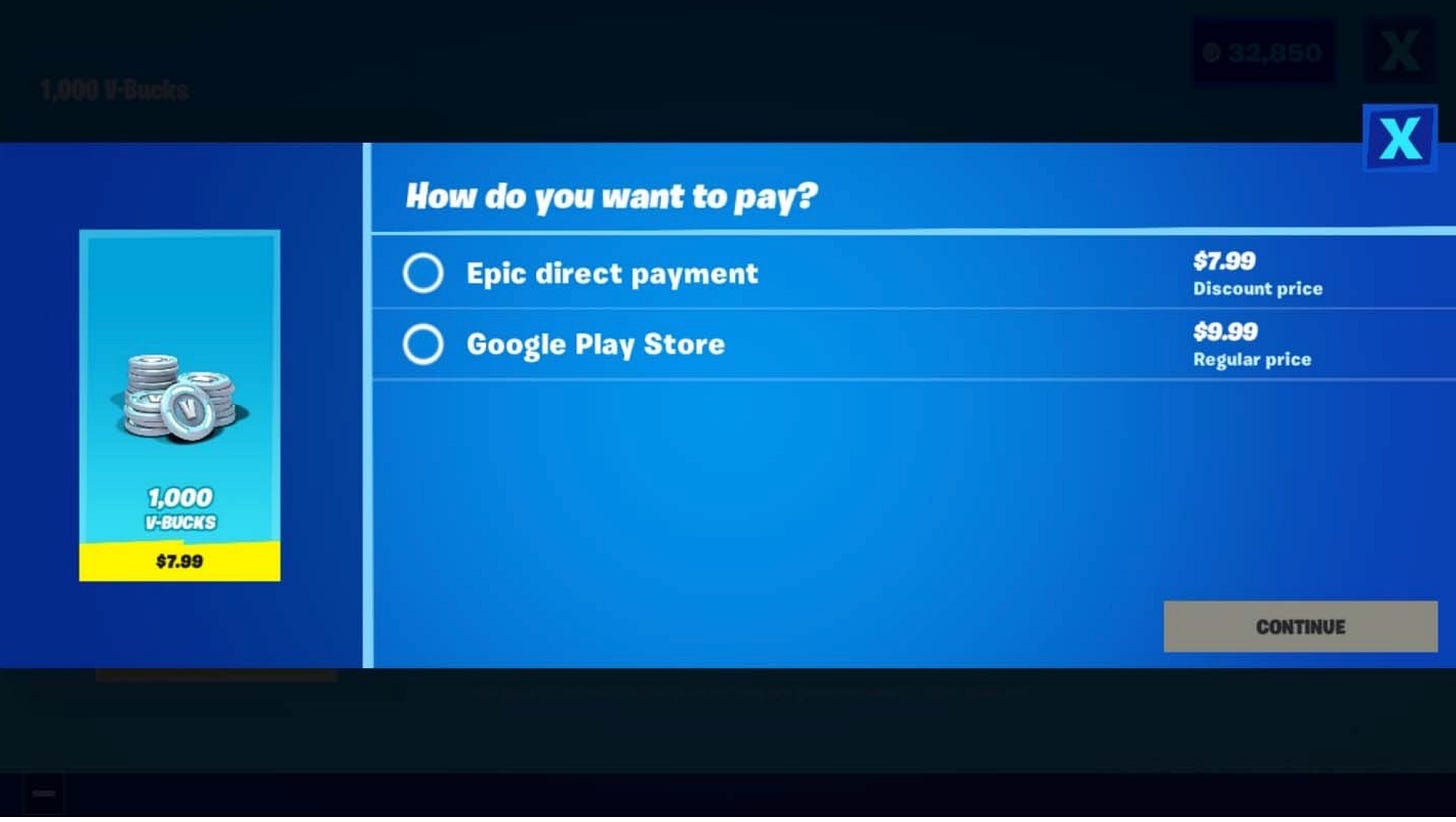

On August 13, roughly a fortnight after the House Judiciary Committee heard testimony from Apple and Google’s CEOs on whether their business practices amount to anticompetitive monopolies, Epic Games began what looks to be a carefully orchestrated campaign against both companies over their respective app store practices. At issue are Apple and Google’s control of their app stores and their fees charged for in-app purchases (30% for both platforms). First, Epic provided players with a direct payment option that bypassed the app stores’ fees, saving customers 20%. This violated both stores’ respective terms of service.

Apple responded with the following statement:

Epic enabled a feature in its app which was not reviewed or approved by Apple, and they did so with the express intent of violating the App Store guidelines regarding in-app payments that apply to every developer who sells digital goods or services.

Both Apple and Google removed the Fortnite app from their respective app stores after Epic’s changes. Epic then filed a 62 page complaint against Apple and a similar 60 page complaint against Google for antitrust violations. Epic also released a spoof video of Apple’s 1984 commercial with Apple taking the role of the totalitarian state and ending with the following call to action:

Epic Games has defied the App Store Monopoly. In retaliation, Apple is blocking Fortnite from a billion devices. Join the fight to stop 2020 from becoming ‘1984’. #FreeFortnite

No such similar video appeared for Google.

COMPLAINTS

Epic’s complaints are similar in many ways, so we will discuss Apple’s as representative of the two. While there are some differences, the core of the issues remain the same. Essentially, Epic argues that Apple and Google use anticompetitive restraints and monopolistic practices in: (1) application distribution; and (2) in-app purchases. In the Apple complaint, there are ten distinct counts under Sections 1 and 2 of the Sherman Act as well as California state equivalents, but they all relate back to those two basic issues. The Google complaint contains 11 counts, but can be similarly distilled.

BRIEF BACKGROUND ON SECTION 1 OF THE SHERMAN ACT

Section 1 of the Sherman Act prohibits unreasonable restraints on trade. Courts normally first look to see if the restraint is so egregious that the practice is always considered unreasonable (referred to as the “per se” rule). Under the per se rule, defendants have no real opportunity to justify the restraint. Some common per se unreasonable business practices include price fixing, bid rigging, and market allocation among competitors. If the business practice is not per se unreasonable, courts use the “rule of reason” approach where they study: (1) whether the practice has significant anticompetitive effects; and (2) whether there are any pro-competitive justifications for the restraint.

BRIEF BACKGROUND ON SECTION 2 OF THE SHERMAN ACT

Section 2 of the Sherman Act prohibits bad behavior or conduct to form a monopoly or to retain monopoly power. Courts analyzing a Section 2 claim will look to see if the accused: (1) has monopoly power within the relevant market; and (2) willfully acquired or maintained that power as distinguished from growth or development as a consequence of a superior product, business acumen, or historic accident.

THE APP DISTRIBUTION MARKET

Epic argues that Apple “imposes unreasonable restraints and unlawfully maintains a monopoly” in the iOS App Distribution Market through technological and contractual means. Epic also argues that there is no pro-competitive justification for those restraints. For example, Epic asserts that Apple’s argument that controlling iOS app distribution is necessary for security and privacy is undermined by Apple’s approach to applications for laptops, which are not similarly constrained. Finally, Epic identifies a number of anticompetitive results from Apple’s restraints, the first of which is the lack of competing app stores (like the Epic Game Store that competes with Steam on personal computers).

It’s worth noting that Epic’s Google complaint does mention the availability of sideloading (loading applications outside of the Google Play Store), but argues that Google makes the process technologically untenable for most consumers.

THE IN-APP PURCHASE PROCESSING MARKET

Epic also argues that Apple “imposes unreasonable restraints and unlawfully maintains a monopoly” in the iOS In-App Payment Processing Market. Epic points to the fact that Apple does not impose similar transaction fees on in-app purchases of physical goods and some services as for in-app purchases as a sign that there are no pro-competitive justification for the restraints. As with the app distribution market, Epic argues that one of the anticompetitive effects is the lack of additional in-app purchasing processors, including Epic’s own payment processing alternative. In both complaints, Epic shows that Apple and Google’s processing fees of 30% are about 10 times higher than competitive payment processor fees (which certainly doesn’t look great):

COMPETITIVE MOBILE DEVICES

One of the challenges Epic will face against Apple is defining the market to just iOS apps and purchases. One clear line of attack would be that the relevant market is all mobile device applications and purchase processing, not just iOS devices. Epic addresses the issue in its Apple complaint by arguing that Apple users are locked into the ecosystem, that Apple dominates the premium mobile market, and that consumers aren’t aware of Apple’s anticompetitive behaviors and how that might affect them (for example, essentially a 30% Apple tax on all applications).

CONCLUSION

These will be closely watched cases, and it looks like Epic isn’t shying away from public attention to the case. In fact, their end goal may be to drive enough awareness and public sentiment that Apple and Google are forced to change their practices instead of what is sure to be expensive and bruising lawsuits. That said, I doubt Apple and/or Google will forgo a substantial revenue source without a fight.